Greater Hanoi Ready-built Landed Property (RBL) Market 2Q2022

Project The Empire Vinhomes Ocean Park stirred up the market

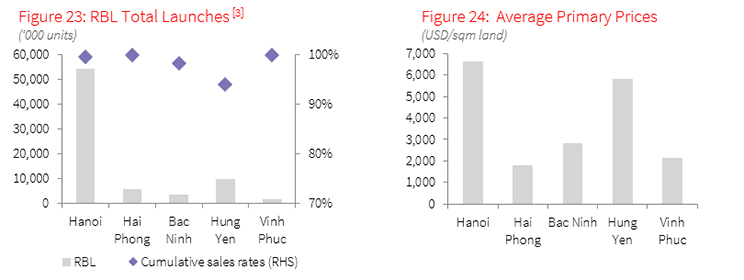

In 2Q22, the RBL market in the Northern region recorded the highest new supply, reaching 7,673 units officially launched, up 5 times q-o-q and 9 time y-o-y. Of these, Hung Yen led the market and accounted for 95.6% of the total units. This was due to the entry of The Empire Vinhomes Ocean Park, a mega project in Hung Yen which stirred up the Northern RBL property market with about 7,300 units in 2Q22. In contrast, the market was quiet in other cities and provinces, with Bac Ninh and Hanoi recording the official launch of only 100-200 units in each area, mainly belonging to the next stage of existing projects

Demand concentrated on the neighbouring provinces

Abundant new supply from neighbouring provinces with selling prices lower than in Hanoi’s level has eased the “thirst for housing” of both investors and homeowners/occupiers. Approximately 7,422 units were sold in 2Q22, equivalent to a growth of 5 times q-o-q and 11 times y-o-y. Hung Yen dominated the market with about 6,800 units from The Empire Vinhomes Ocean Park. Meanwhile, given the scarce supply, neighbouring provinces such as Bac Ninh and Vinh Phuc only recorded new take-ups of about 100-220 units each, mostly coming from projects with better prices (ranging from USD 1,800 to USD 3,400/sqm land). In Hanoi market, a high take-up rate was recorded in projects located in the West and Northwest of the city, within a radius of 10-15km, such as An Vuong Villas (Ha Dong), Hinode Royal Park (Hoai Duc) and Avenue Garden (Nam Tu Liem).

Primary prices continued to increase strongly

The average primary selling price of Greater Hanoi reached USD 5,083/sqm, up by 21.1% y-o-y. In the four neighbouring provinces, while primary selling prices in Bac Ninh increased sharply by 2.4% q-o-q, Hung Yen recorded a decline of 16.6% q-o-q due to the entrance of new projects with selling prices lower than the market average. Meanwhile, the average primary price in Hanoi also recorded an increase of 15.8% q-o-q, given the large gap between supply and demand, scarce land bank and expensive input costs.

Outlook: Primary selling prices continue to increase but at a slower pace

In 2H22, primary selling prices are expected to keep increasing, but at a slower pace than in 1H22. Many large-scale projects have been proceeded with soft launches and receiving bookings for the next phases. It is expected that attractive selling policies with high discount rates or diversified loan periods in these large-scale projects will help ease the growing primary selling prices. Moreover, with the credit tightening policy influencing real estate investment, some developers have applied a sort of financial cooperation with buyers with a committed interest rate to solve difficulties in raising capital.

Note:

[1] Greater Hanoi area consists of Hanoi, Hai Phong, Bac Ninh Hung Yen and Vinh Phuc markets.

[2] Prices exclude VAT and sinking fund/maintenance fee. Price per sqm land = total unit value / size of the land plot on which the property is built.

[3] Official launch: Projects are considered as officially launched when the Sale Purchase Agreements are signed, typically upon infrastructure completion.

Source: JLL Research