Will Suganomics Boost Japan’s Real Estate Market Transparency?

On September 16, Japan’s 99th Prime Minister Yoshihide Suga, announced to accelerate Digitalisation and Decarbonisation, exactly what is required in the current global real estate market. JLL expects this move to spur investment activities in Japan.

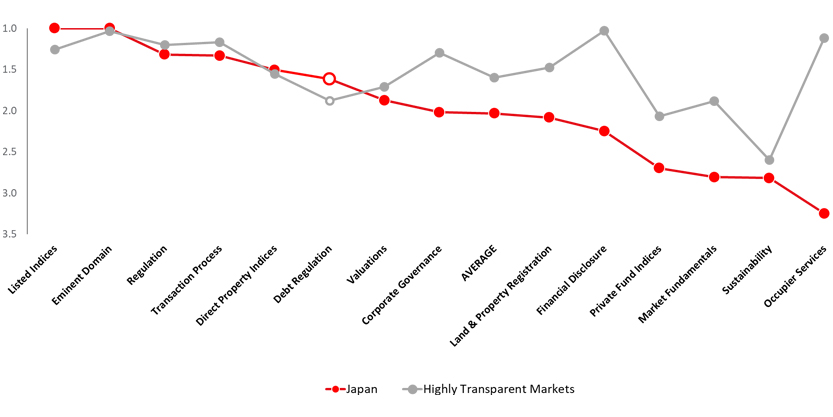

The COVID-19 pandemic has severely impacted the global real estate market. Amid these environmental changes, JLL launched the Global Real Estate Transparency Index 2020. The latest survey ranked Japan as the 16th most transparent real estate market globally, down two positions from the 2018 survey despite slight improvement in its absolute score. However, Japan remains firmly in the cusp of transparent real estate markets.

Figure 1: Japan’s transparency by topic area

Going forward, Japan needs to address certain important areas in order to improve its real estate transparency ranking. Firstly, the country needs to implement proptech to expand market information and improve transaction processes. Compared to other industries, Japan’s real estate industry has been slow to adopt technology. The proliferation of proptech has accelerated since the pandemic. New online services, sharing economy platforms, smart buildings and smart cities are improving transparency by facilitating access to the utilisation of new data. The use of smart buildings, big data, real estate management and visualisation tools are widespread in highly transparent markets, but Japan lags behind other countries, ranking 35th globally in the latest survey. Several proptech startups are established in Japan, but it will take time for the market to adopt technologies widely.

Figure 2: Proptech Adoption

|

Source: JLL Global Real Estate Transparency Index 2020

The government is making efforts to improve IT and make real estate transactions available online. Following the spread of COVID-19, various issues have become apparent, such as delays in the digitalisation of government services as well as in the private sector. Prime Minister Yoshihide Suga announced his intent to abolish imprinting stamps on applications to the government, as they hinder teleworking. By adopting online procedures, Japan’s real estate transaction process could run more smoothly.

The second one is emphasis on Environmental, Social, and Governance (ESG). Japan already has a high standard in the field of sustainability in terms of real estate environmental performance evaluation, energy consumption benchmark, energy efficiency standard, and the carbon dioxide emission report represented by CASBEE (Comprehensive Assessment System for Built Environment Efficiency). However, when compared to the most transparent markets, some social aspects in real estate still need to be addressed, e.g. putting the human experience at the centre of workplace design and operation.

A few other measures:

Green building financial performance indices – Although still few in number throughout the world, the development of an index that objectively shows the performance of green buildings, such as investment returns, is needed. As seen in the world of financial and equity investments, consideration for the environment has already begun to be linked directly to performance and this will permeate into the real estate sector.

Climate-resilient building standards – The concept of climate resilience is relatively new in Japan, but the impact of climate change on buildings and their resistance is drawing attention globally. There is growing interest in the risks of physical real estate due to climate change, as pointed out by the Task Force on Climate-related Financial Disclosures (TCFD). The real estate industry is also working on resilience to address these risks, which will have a significant impact on building design, city planning and tenant utilisation.

Net-Zero Carbon Building Framework – According to the Ministry of Environment, Japan aims to achieve an average ZEB (net-zero energy building) for new buildings by 2030. Addressing climate change is essential, and the economy for decarbonisation requires new transparency. New frameworks, regulations and metrics will require reporting on net-zero carbon buildings and carbon-dioxide emissions while establishing energy efficiency.

Health & Wellness Certification – Like many transparent markets, CASBEE has introduced a wellness office certification which evaluates the impact on the health and comfort of building occupants. Due to COVID-19, environmental factors, such as hygiene, health, and work-life-balance awareness is increasing. Real estate owners and operators are required to consider the safety and health of people who work in the building. Today, not only power consumption or noise is measured, items such as ventilation, air cleaning, and cleaning inside the building are also quantified. Transparency on a building’s health will become even more important in the future.