Greater HCMC Ready-built Landed Property 1Q2022

RBL remains a favoured investment sector

RBL supply from HCMC is steadily increasing

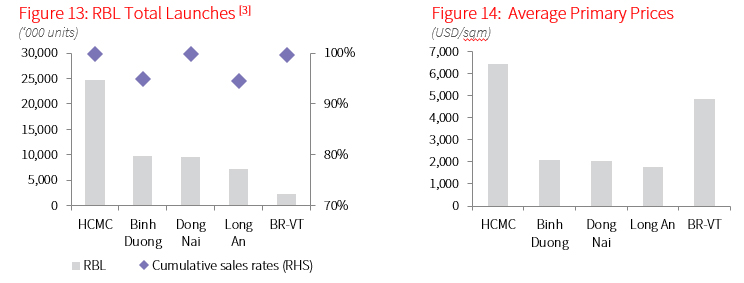

In 1Q22, the new supply added 2,775 units, in which new supply in HCMC increased significantly to 992 units mostly from projects cleared of legal difficulties and signed SPA during the quarter. Meanwhile, the soft launching activities in HCMC in 1Q22 remains low.

The lack of new supply due to a scarcity of land in the inner city, particularly in HCMC, along with the growth of urban infrastructure, encourages the RBL market to continue expanding farther from the city centre.

RBL remains a favoured investment sector

In 1Q22, new sales totalled 2,986 units, an increase of 736 units over the previous quarter. Transaction volume from previously launched projects climbed considerably in HCMC. While the outskirts of HCMC stabilised the new sales, the quarter totalled 1,801 units.

With current global inflation and credit restrictions in real estate, demand for RBL as a long-term investment of idle-capital holders rose and dominate the purchasing demand in this quarter.

Primary prices in HCMC are rising in comparison to Greater HCMC

The primary selling price of RBL in Greater HCMC was stable by the quarter but maintained its y-o-y growth momentum, increasing by 1.7% q-o-q and 15.9% y-o-y, reaching USD 3,007 per sqm due to a shortage of supply. At the same time, demand remained high, even accelerated after the pandemic. Due to a lack of new supply and the continuity of cash-flow investment into RBL, HCMC's primary selling price grew by 2.2% q-o-q and 20.6% y-o-y.

Except for BR-VT, baskets on the primary market remain plentiful. Due to a scarcity of new supply, just one project in the BR-VT market remains in the primary market, with a selling price of roughly USD 4,800 per sqm of land.

Outlook: Limited supply expected in HCMC

New supplies in HCMC will remain restricted for the next nine months, with a projected amount of 505 units. Meanwhile, by the end of 2022, around 8,000 units are scheduled to be ready for sale in four neighbouring provinces. Government’s tightening measures in real estate and the priority to revive the industrial sector after a protracted period of epidemic will help to ensure the market stability but may hamper the real estate market growth. Only developers and buyers with strong financial capability can maintain the position in this market circumstance. Greater HCMC's RBL market is predicted to steadily develop in terms of product quality. Large-scale RBL projects combining multiple interior facilities with smart infrastructure will increase the amenity factor, which used to be a disadvantage of RBL projects compared to apartment products.

Note:

- Greater HCMC area consists of HCMC, Binh Duong, Dong Nai, Ba Ria – Vung Tau and Long An markets.

- Prices exclude VAT and sinking fund/maintenance fee. Price per sqm land = total unit value / size of the land plot on which the property is built.

- Official launch: Projects are considered as officially launched when the Sale Purchase Agreements are signed, typically upon infrastructure completion.

Source: JLL Research