Southern Industrial Land and Ready-built Factory (RBF) 2Q2022

The market welcomed new supply in Long An and Binh Duong

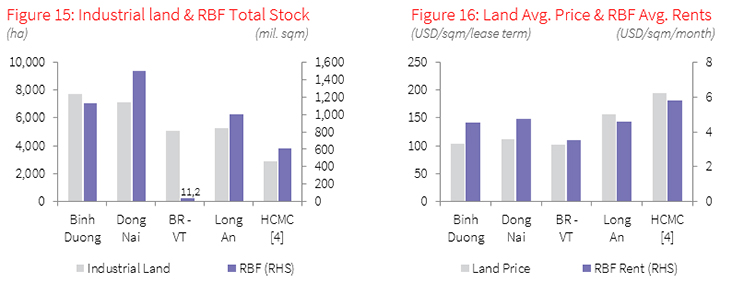

The industrial real estate market in the South continued to witness vibrant development with a significant increase in new supply. In 2Q22, the total leasable area of industrial land and RBF reached 28,097 ha and 4.2 million sqm, respectively. Notably, Long An Province recorded Viet Phat IP being officially put into operation, and Nam Thuan IP, with a total area of 217 ha, holidng a ground-breaking ceremony. Frasers Property’s RBF in Binh Duong IP, which started construction in 4Q21, was completed and officially launched in 2Q22, adding more than 40,000 sqm of RBFs to the market. Besides, Dong Nai is set to welcome 22,700 sqm of RBFs developed by KCN Vietnam in Ho Nai IP. The project just started construction in April and is expected to be completed by the end of 2022.

Occupancy rates declined slightly in both markets

Newly established IPs and launched RBF projects in 2Q22 have temporarily impacted the occupancy rates in both markets, decreasing at 83.6% and 87.9%, respectively. Although, new supply required time to be absorbed, notable transactions recorded in Binh Duong and Dong Nai indicate the the positive sign of supply is being destocked continuously. For example, Pandora Group has invested in building a jewellery plant in VSIP III IP, Binh Duong, with a total capital of up to USD 100 million. The RBF market also received interest from small and medium-sized manufacturing companies, particularly in areas attracting a diverse range of industries, such as An Phuoc IP and the IP cluster in Nhon Trach, Dong Nai.

Land prices continued to rise, whilst RBF rents remained stable

In 2Q22, IP land prices recorded a remarkable growth, up 10.7% y-o-y, reaching USD 125/sqm/lease term. The average price was raised thanks to the new supply recorded in Long An, which has a prime location and convenient infrastructure connection to HCMC. RBF rents saw a modest increase of 0.52% compared to 1Q22 and remained stable at an average of USD 4.8/sqm/month. The landlords offered RBF rents at competitive rates to quickly fill newly completed facilities.

Outlook: Implementing the eco-IP model, RBF is flexible in use

Decree 35/2022/NĐ-CP, in effect from July 22, provides detailed regulations regarding some of IP development models, notably the eco-IP, with encouraging policies, investment incentives and procedures for the establishment and certification of eco-IPs. This is considered a solution that not only addresses limitations and inadequacies of environmental issues relating to industrialisation but also promotes sustainable growth and efficient use of resources and energy. Ready-built property market has begun to popularise hybrid facilities that can be convertible between factory and warehouse depending on the tenant’s. Developers have utilised flexibility in land use purposes to build this hybrid model to meet the unique requirements of different clients.

Note:

[1] Southern area consists of HCMC, Binh Duong, Dong Nai, Ba Ria – Vung Tau and Long An markets.

[2] Land prices exclude Infrastructure maintenance fees, service fees and VAT. Lease term means the remaining land lease term of the project life time.

[3] Rents exclude VAT and service charges.

[4] Saigon High-tech Park and Quang Trung Software Park are not included in the surveyed basket owing to their special characteristics.

Source: JLL Research