Southern Industrial Land and Ready-built Factory (RBF) 1Q2022

Occupancy rate remained stable

The market welcomed the new supply

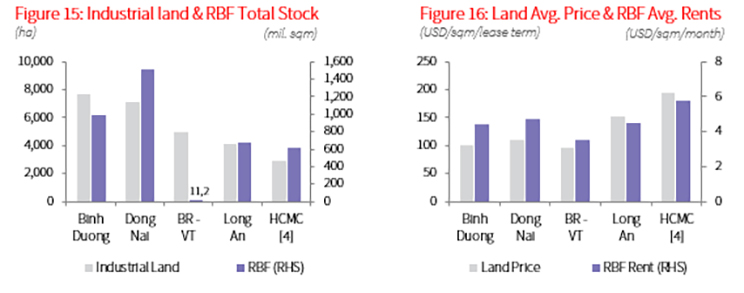

The restoration of international flights to Vietnam has brought positive signals to the industrial market in early 2022. Projects that were expected to enter the market have officially been put into operation. This has helped the total leasable area of Industrial land and RBF to grow significantly in 1Q22, reaching 26,724 ha and 3.8 million sqm, respectively. Notably, VSIP 3 in Binh Duong held a ground-breaking ceremony, and Amata Long Thanh Hi-tech IP, Dong Nai, received the land lease decision. Aside from the construction completion of existing projects, the RBF market recorded two newly started projects, namely KCN Vietnam RBF in Phu An Thanh IP, Long An and Frasers Property RBF in Binh Duong IP. These projects are estimated to add to the RBF market more than 85,000 sqm by the end of 2022.

Occupancy rate remained stable

Despite an increase in new supply into the industrial land and RBF markets, the occupancy rate in 1Q22 witnessed slight changes, at 85% and 89%, respectively. This showed that the demand for leasing land and factories is still surging post-pandemic. IPs in Binh Duong and Long An continued to be bright locations, attracting the attention of investors. Although VSIP 3 has just started construction, more than 30 corporations and companies have shown interest and made enquiries about production development, equivalent to 175 ha of industrial land. Long An also welcomed Coca Cola’s factory investment project of USD 136 million in Phu An Thanh IP and the first two Ready-built warehouse projects of BWID in Xuyen A & Vinh Loc 2 IPs.

Land prices hit a new peak, whilst RBF rental growth slows

This quarter, industrial land prices still sustained a strong growth momentum and peak at USD 120/sqm/lease term, up 9.0% y-o-y, thanks to a new wave of FDI flowing into Vietnam after the reopening of international borders. On the other hand, with the RBF market emerging with a remarkable increase in supply, rents have relatively stabilised at USD 4.8/sqm/month for the whole region, up only 0.93% q-o-q.

Outlook: Smart IP and RBFs tend to move to large scale

Besides the price and location, the emergence of IP models applying new technologies, such as Big Data, IoT (Internet of Things), and Artificial Intelligence (AI), is predicted to be a competitive advantage in appealing investment and impacting future land prices. The RBF market has moved to a larger scale to meet the tenants’ demands, especially foreign clients who want to lay the foundation or expand production in Vietnam but want to save time and costs and quickly go into operation. Due to the increasingly limited industrial land bank, multi-storey RBF is being considered as a solution in the near future for investors to help expand space and optimise land-use efficiency.

Note:

- Southern area consists of HCMC, Binh Duong, Dong Nai, Ba Ria – Vung Tau and Long An markets.

- Land prices exclude Infrastructure maintenance fees, service fees and VAT. Lease term means the remaining land lease term of the project life time.

- Rents exclude VAT and service charges.

- Saigon High-tech Park and Quang Trung Software Park are not included in the surveyed basket owing to their special characteristics.

Source: JLL Research