HCMC Retail Market 1Q2022

Anchor tenants’ movement and expansion drive 1Q22 take-up

Landlords remain cautious

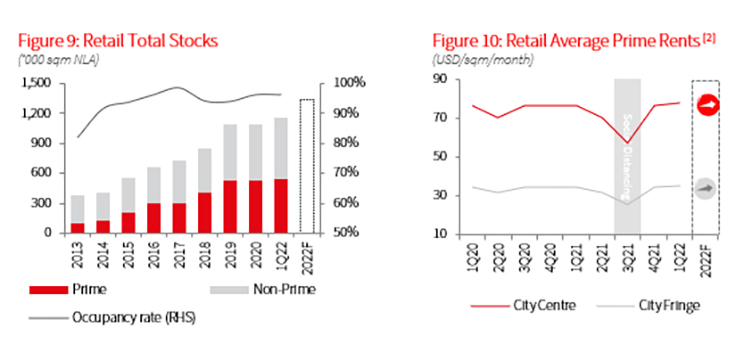

New supply was mute this quarter, with most new projects pushing the opening date even further. Leasing momentum has been on the rebound, encouraged by the Government's new policy to reopen for international tourists from late March, which would substantially influence footfall in City Centre and pave the way for new projects to be put into operation.

Anchor tenants’ movement and expansion drive 1Q22 take-up

Shopping mall occupancy improved steadily as net absorption in Prime malls increased more than 14,000 sqm in 1Q22, thanks to the expansion of Anchor tenants and retail chains. Meanwhile, the presence of Anchor tenants in Prime malls has helped to attract more leasing activities in these malls.

UNIQLO continued to underpin new leasing activity across the market, opening new branches at Aeon Mall Binh Tan and Saigon Centre. Domestic retailers continued driving new leasing activity in shopping centres and traditional retail stores. Significant opening of new branches in 1Q22, including Chuk Chuk, Con Cung and Nova Market, witnessed many leasing transactions.

Rents see a modest recovery

Prime net effective rent recorded a slight growth of more than 1.3% q-o-q to USD 41.5 per sqm per month and equilibrated to the historical norm before the pandemic. While rental support has been removed, several landlords willing to negotiate rent with specific tenants who needs support on a case-by-case basis.

Outlook: Price escalation in parallel with positive economic signals

With the pandemic under control and positive expectations for the future, there is a good chance that quite a few upcoming malls that postponed their opening could bring up the supply in 2022, bringing up to more than 100,000 sqm.

New supply sources at good locations and smart leasing strategies will help increase average rents based on economic recovery after the pandemic.

Besides, rents in existing mall are expected to grow at a modest pace as well, in line with current demand from the retailers in their expansion plan. F&B, entertainment, convenience store, and pharmaceutical are likely to drive demand over the remainder of the year.

Note:

- Prime rents refer to average net effective rent of Prime Mall across the city, excluding VAT and service charges. Please refer to terminology for definition of Prime Malls

- City Centre refers to District 1. City Fringe refers to the rest of the city.

Source: JLL Research

As the market develops, we regularly review and update our classification and grading system as well as the methodology to ensure the relevance and focus of our research on the actual market situation.

Since 1Q21, in this report:

- Supply indicators to cover malls classified as Community Centre, Regional Shopping Centres and Super Regional Centre.

- Performance indicators only cover prime retail properties (a subset of the supply basket above). This is one of the most highly sought-after property types on the market.

Subsequently, this revision might result in some changes in the historical data.

Please refer to the Terminology for detailed definitions of all the new terms mentioned above.