Greater Hanoi Ready-built Landed Property (RBL) Market 1Q2022

Primary prices continued to record a strong increase

Many new projects entered the satellite provinces

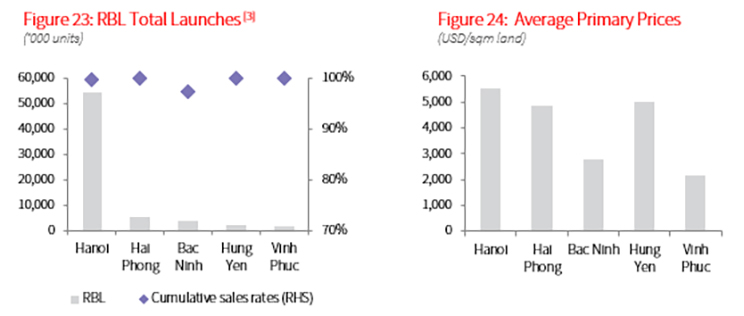

In 1Q22, the total new supply of the RBL market in the Northern region improved by nearly 1,400 units, two times higher than in 4Q21. Hanoi continued to dominate the market with 54% of the total new supply, mainly from the next phases of large-scale projects in the West, like Hinode Royal Park ( Hoai Duc), An Vuong Villas ( Ha Dong), and the entry of a new project, Eurowindow Twin Park ( Gia Lam) in the East. Concurrently, the launching activities were active, achieving the highest growth of new supply since 2021, with 637 units, mainly coming from new projects such as BRG Coastal City (Hai Phong), Policity Kim Do and Vietsing Square (Bac Ninh).

Demand remains resilient

Demand for RBL in the Northern market remained resilient, with around 1,461 units taken. In Hanoi, communes located 10-15 km from CBD, like Hoai Duc and Gia Lam, continued to show the attraction when the existing inventory from big projects like Hinode Royal Park, Eurowindow Twin Park was quickly sold out in the soft and official launch period. In the nearby provinces, the scarcity of supply at good locations and reasonable prices (from USD 1,800 – USD 3,400/sqm of land) make new projects attract investors and sell out quickly. The total sale volumes in four satellite provinces reached 603 units, of which 50% were from newly launched projects in 1Q22.

Primary prices continued to record a strong increase

The average primary price of Hanoi and the nearby provinces was USD 4,799/sqm, up by 2.7% q-o-q and 12.2% y-o-y. Due to the sizeable supply-demand gap, increasing raw material cost and high investment demand toward well-planned projects at prime locations which likely exploit the future business potential, most under-construction projects recorded a sharp increase in the selling price, at 7.1% q-o-q. In four satellite provinces, while the selling price of Bac Ninh climbed up by 10% q-o-q given the entry of one project with a sale price above USD 5,000/sqm, the figure for Hai Phong recorded a significant decrease of -9.6% q-o-q, as one new project had the selling price below the average market rate. The selling price in Hung Yen and Vinh Phuc remained stable on a quarterly basis across all existing projects and the market welcomed no new supply.

Outlook: Supply will recover in 2022

In the next nine months, the future supply is projected to be around 6,000 units. Hanoi accounts for 50% of the total number, mostly coming from complex, well-planned projects with clear rights and no legal issues. In addition, banks tightening the loans terms and interest rates for the real estate sector is expected to push developers to diversify its capital sources to be able to implement projects on the committed schedule. This will also negatively affect demand in the short term, especially for investment buyers using financial leverage.

Note:

- Greater Hanoi area consists of Hanoi, Hai Phong, Bac Ninhm Hung Yen and Vinh Phuc markets.

- Prices exclude VAT and sinking fund/maintenance fee. Price per sqm land = total unit value / size of the land plot on which the property is built.

- Official launch: Projects are considered as officially launched when the Sale Purchase Agreements are signed, typically upon infrastructure completion.

Source: JLL Research