Hanoi Retail Market 1Q2022

Negative net absorption continued to cloud the market

New shopping malls continued to defer the opening date

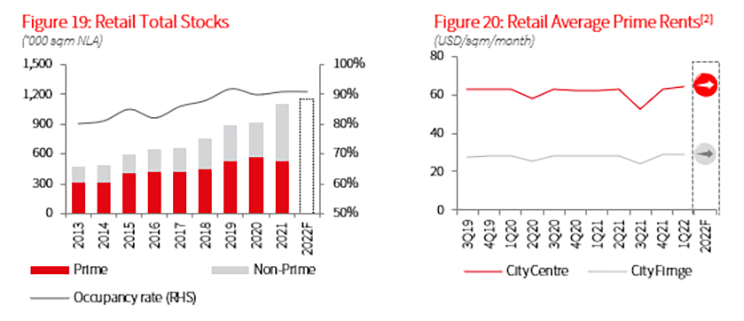

As Hanoi peaked its Covid cases in March, landlords found it difficult to reach the targeted occupancy rate on the opening date, and thus had to reschedule to later this year. Hanoi retail market’s total supply remains stable at 1.09 million sqm NLA, mainly in non-CBD areas.

Some malls used low-traffic time as an opportunity to renovate, such as Indochina Plaza Hanoi in Cau Giay district. In general, the total vacant space of Prime Mall in Hanoi was more than 50,000 sqm NLA, in which most of the available sites ranged from 350 to 500 sqm.

Negative net absorption continued to cloud the market

Prime Mall continued to be affected by Covid-19, especially when the situation in Hanoi became more complicated in 1Q22, with negative net absorption at -6,407 sqm across the city. Despite one notable deal of 1,000 sqm in AEON Mall Ha Dong, negative net absorption continued to cloud the market as small domestic retailers had to shut down their inefficient stores. Some tenants who provided services such as game zones or kids playgrounds also closed temporarily as customers avoided crowded places.

Rent increased slightly compared to the previous quarter

Overall, rents at Prime Mall in City Centre and City Fringe reached USD 63.6/sqm/month and USD 28.7/sqm/month in 1Q22, increasing 1.3% and 0.3% q-o-q, respectively. Net effective rent in City Centre and City Fringe increased slightly by 0.5% y-o-y as shopping malls returned to normal operations and landlords wanted to increase the rental rate following natural growth after two years of staying muted during the pandemic. However, price adjustments following the inflation rate mainly happened in malls with reasonable occupancy rates and less impacted by the pandemic. Landlords remained flexible in considering the best rental price for tenants based on their product category, lease area and leasing term.

Outlook: Market expects integrated and optimized shopping malls

Vincom Smart City, with 40,800 sqm, will be the highlight of new supply in 2022. Regarding market performance, the occupancy rate in existing retail prime malls is expected to increase as customer purchasing power improves later. However, with the adoption of online shopping behaviour over the last two years, tenants, especially foreign retail brands, will develop several new store models for a better customer experience, for example, buying online and picking up or interactive retail stores. This requires developers to make changes in how they design and operate new projects to keep up with the latest trends.

Note:

- Prime rents refer to average net effective rent of Prime Mall across the city, excluding VAT and service charges. Please refer to terminology for definition of Prime Malls

- City Centre refers to Hoan Kiem, a part of Ba Dinh and Hai Ba Trung District. City Fringe refers to the rest of the city.

Source: JLL Research

As the market develops, we regularly review and update our classification and grading system as well as the methodology to ensure the relevance and focus of our research on the actual market situation.

Since 1Q21, in this report:

- Supply indicators to cover malls classified as Community Centre, Regional Shopping Centre and Super Regional Centre.

- Performance indicators to cover Prime retail properties only (a subset of Supply basket above). This is one of the most highly sought-after property types on the market.

Subsequently, this revision might result in some changes in historical data.

Please refer to Terminology for a detailed definition of all the above new terms.