Northern Industrial Land and Ready-built Factory (RBF) 1Q2022

Land prices and rents remain unchanged

Industrial land market has new supply

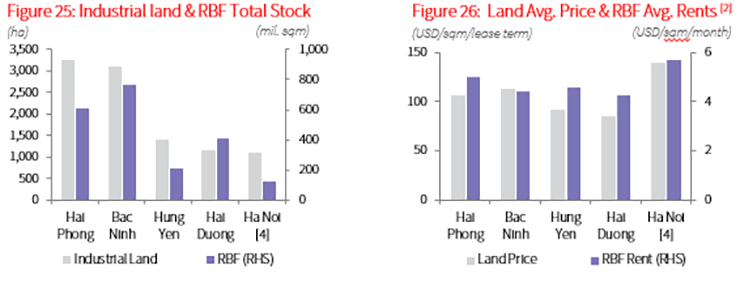

The ground-breaking event of Thuan Thanh I IP, Bac Ninh, brought a positive signal to the market in the first quarter of the new year, adding 160 ha of land for lease and increasing the total industrial land area in the North to over 10,024 ha. The RBF market in 1Q22 did not record any new supply. The total supply in the North remained stable at 2.2 million sqm.

Occupancy rate in the Northern region remains above 80%

1Q22 continued to record the heavy impact of the Covid outbreak on business activities of manufacturing enterprises when the number of infections increased sharply in the northern provinces. However, as businesses and communities flexibly adapted to the new normal, the industrial production in the quarter grew strongly. FDI inflows into industrial zones in the North showed strong growth. Notably, in Bac Ninh, VSIP increased the investment capital by nearly 941 million USD. Goertek Group's manufacturing plant project in Que Vo IP increased the investment capital by roughly USD 306 million. The occupancy rate of industrial parks in the North remained at 80%, up sharply from 75% in the same period last year. The occupancy rate of RBF also continued to be high, reaching 98%.

Land prices and rents remain unchanged

The asking price in 1Q22 reached USD 109 per sqm per lease cycle, slightly decreased compared to the last quarter due to more favourable rents in some IPs in less convenient locations accelerating to fill up vacancies. However, prices maintained a fast growth rate, increasing 9.2% y-o-y. Meanwhile, RBF rent remained unchanged compared to 4Q21, reaching USD 4.7 per sqm per month, up 3.5% y-o-y.

Outlook: The industrial market in the North continues to be active

In 2022, along with the opening of flight routes and the application of vaccine passports to restore the economy and efforts to attract investment, the northern industrial market is expected to continue to be the choice of foreign investors.

The industrial land supply in 2022 promises to be abundant as the provinces bordering Hanoi have plans to deploy industrial parks in the area. Notably, Xuan Cau and Hai Phong IPs have been granted investment certificates by Hai Phong EZ. Meanwhile, in Hai Duong, Binh Giang 2, Thanh Ha and Kim Thanh IPs have been added to the provincial industrial zone planning. In Hung Yen, IP No. 5 has also been approved for the 1/500 planning.

In the RBF market, some outstanding projects are expected to be launched this year, such as the RBF (Phase 1) of the KTG-BKIM joint venture in Yen Phong II-C IP, and Phase 3 of BW’s RBF in VSIP Hai Duong IP. These will add to the currently limited supply of RBF.

Note:

- Northern area consists of Hanoi, Hai Phong, Bac Ninh, Hung Yen and Hai Duong markets.

- Land prices exclude Infrastructure maintenance fees, service fees and VAT. Lease term means the remaining land lease term of the project life time.

- Rents exclude VAT and service charges.

- Hoa Lac High-tech Park is not included in the surveyed basket owing to their special characteristics.

Source: JLL Research