Greater HCMC Ready-built Landed Property 2Q2022

Supply remained firm

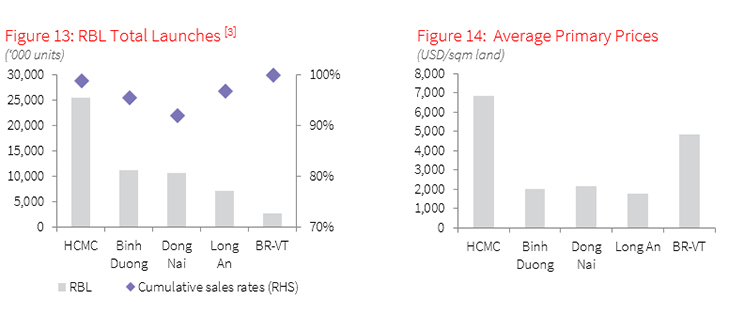

RBL’s total supply in HCMC reached 25,439 units as of 2Q22, which was stable q-o-q due to the limited number of new launches this quarter.

Meanwhile, the supply continued to expand to Greater HCMC with 2,362 new units launched in 2Q22, helping the cumulated total to exceed over 32,000 units. Dong Nai and Binh Duong continued to lead the new launch RBL supply with 1,256 and 1,076 units, respectively.

High demand for Townhouse product type

With constrained new supplies, HCMC recorded 588 new sold units in 2Q22, a decrease of 50% q-o-q. Demand in Greater HCMC remained stable, with 1,724 units sold during the quarter, of which the two with maximum sales are Binh Duong and Dong Nai, with 937 and 670 units, respectively.

Townhouses, with selling prices in the range of VND 6–8 billion per unit in HCMC and VND 5–6 billion per unit in Greater HCMC, drew the highest new demand in 2Q22 owing to their affordability. During 2Q22, an estimated 1,548 townhouses at these two price ranges were sold out, representing 76.1% of the market's total sold.

Primary selling prices continued to grow rapidly

The average primary selling prices across HCMC and Greater HCMC rose 12.4% y-o-y to USD 3,202 per sqm of land. In HCMC, price growth rates are even higher, by 21.2% y-o-y, due to newly launched projects in better locations with higher-than-average selling prices.

In Greater HCMC, Townhouse products with a range price of VND 5–6 million per unit recorded the strongest price increase, at around 11–13% y-o-y

Outlook: Demand for RBL is expected to increase in Greater HCMC

2Q22 forecast of new supply for this year is adjusted downward compared to the previous quarter forecast since the tightening licensing process for new residential housing projects has continued to weigh on the new supply. The market grows more stable, with total new supply to reach roughly 25,000 units in 2022, with more than 55% of new supply concentrated in Thu Duc City.

The selling price is expected to increase but at a slower pace due to the impact of credit risk control policies in some potentially risky real estate projects and the number of new supply improving compared to that during the pandemic period.

Note:

[1] Greater HCMC area consists of HCMC, Binh Duong, Dong Nai, Ba Ria – Vung Tau and Long An markets.

[2] Prices exclude VAT and sinking fund/maintenance fee. Price per sqm land = total unit value / size of the land plot on which the property is built.

[3] Official launch: Projects are considered as officially launched when the Sale Purchase Agreements are signed, typically upon infrastructure completion.

Source: JLL Research