Hanoi Apartment for Sale Market 1Q2022

Primary selling prices climb up on a yearly basis

New supply continues to recover as the pandemic normalises

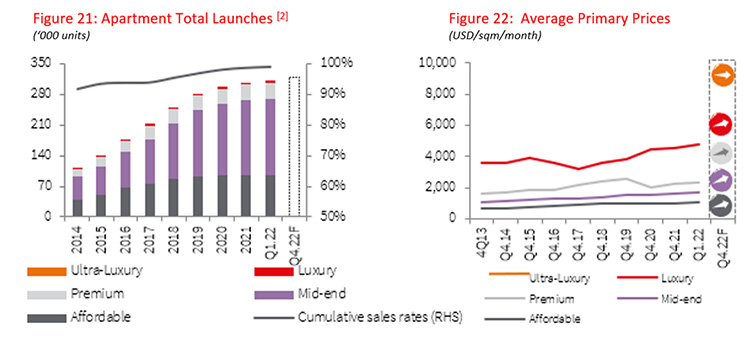

In 1Q22, the Hanoi apartment market recorded 3,260 units opened for sale, up by 7.3% q-o-q and down by -10.6% y-o-y. Despite a negative annual growth rate, the total new supply signalled a gradual recovery following the country entering the “pandemic normalisation” phase. The Mid-end segment led the market, making up 75% of the total new supply, mainly from existing projects such as Vinhomes Gia Lam: Vincity - The Pavilion phase (nearly 650 units), Imperia Smart City (~300 units). The market especially welcomed two new projects in the outer districts: The Essensia (Mid-end, total scale of 496 units) and Tecco Diamond (Affordable, total scale of 665 units).

Demand for apartments increases after Lunar New Year

The improvement in supply and apprehensions that inflation would escalate housing prices have bolstered the demand for apartments, especially from real owner-occupiers. In 1Q22, the total sale volume was 4,391 units, up by 31.7% q-o-q. The Mid-end segment accounted for 74.6% of the total sale, mainly from large scale projects like Vinhomes Ocean Park (Gia Lam) and Vinhomes Smart City (Nam Tu Liem). High demand not only appeared in districts with positive market sentiments like Gia Lam and Nam Tu Liem but was also witnessed in some outer districts such as Hoai Duc and Thanh Tri. These communes also recorded high net absorption, thanks to projects that met middle-class customers’ demand at a time when the market lacked affordable supply and the selling price was being escalated.

Primary selling prices climb up on a yearly basis

The primary selling price of the Hanoi apartment market peaked at 1,729 USD/sqm, up by 11.2% y-o-y. This is the highest annual increase in the last ten years. In addition to the shortage of new supply during the epidemic period, the expensive cost of construction materials and the entry of some Premium and Luxury projects also contributed to the substantial increase in the primary price. Nevertheless, the figure for Mid-end apartments showed a steep climb when many projects in this segment had an annual selling rate up to 10%.

Outlook: Supply and demand will be affected as banks tighten loans

The entry of many Luxury-segment projects such as Heritage West Lake (Tay Ho) or Ultra-Luxury like The Grand (Hoan Kiem) is expected to push up the primary market price. Moreover, the bank policy that tightens loans for the real estate sector will significantly affect both supply and demand in the coming time. For small developers, the difficulty in accessing capital resources can lead to project delays, reducing the construction scale and affecting the project’s sales progress and the payback schedule. Meanwhile, demand from the group of investment buyers will decrease. The group of real owner-occupiers who need to leverage finances to buy apartments will also face difficulties in the coming time.

Note:

- Prices exclude VAT and sinking fund/maintenance fee.

- Official launch: Projects are considered as officially launched when the Sale Purchase Agreements are signed, typically upon foundation completion.

Source: JLL Research