Hanoi Retail Market 4Q21

Net asking rent returned to stability

No new completions entered the market

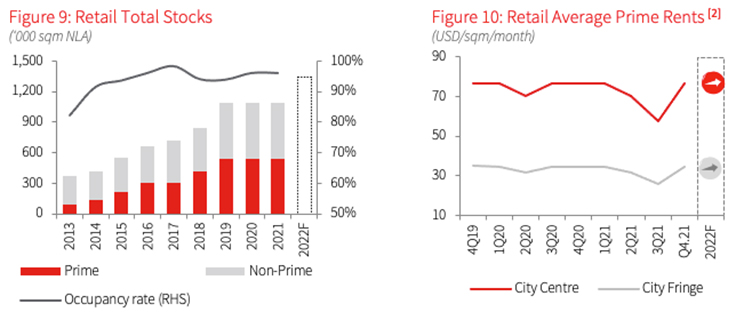

No new supply entered the market this quarter. Amid the outbreak of the pandemic, several shopping centres scheduled to open later this year have had to delay due to low pre-opening occupancy rates. Thus, Hanoi retail market closed 2021 with total supply remaining stable at 1.09 million sqm NLA, mainly in non-CBD areas.

Minor brands continue getting pressure from Covid-19

Overall, demand has not fully recovered yet. Net absorption rate decreased by 1,016m2 in Q421 under severe Covid-19 outbreaks. The market saw numerous small domestic brands forced to close due to weak financial resources. Meanwhile, tenants with large finances slowed down their plan of expansion. Uniqlo opening its 9th store of 1,000m2 at AEON Mall Ha Dong was one of few bright spots in the turbulent 2021.

Customers' purchasing power weakened significantly after two waves of Covid-19 outbreaks. Although brands constantly launched stimulus promotions such as Black Friday sales, many malls seemed to be highly sparsely populated.

Net asking rent returned to stability

Rents at prime malls have returned to USD 32.18/m2/month, as discount/free rent policies were postponed after malls were allowed to reopen. However, in a time when the retail industry is still wounded by the pandemic, landlords are willing to consider short-term support policies based on specific business situations of different clients. Rents in the CBD and non-CBD in Q421 reached USD 62.8/m2/month and USD 28.6/m2/month, respectively.

Outlook: New supply mainly in non-CBD areas

JLL predicts that Hanoi retail market in 2022 will welcome about 73,454 m2, mostly located in the non-CBD areas, 56% of which comes from the Vincom Smart City project. The new supply accompanied by the expansion of major brand chains is expected to vibrate Hanoi retail market after a gloomy Covid-19 year.

In addition, amid the breakneck speed of e-commerce development, landlords would consider the "one destination – many amenities" model to optimise real-life experiences and attract customers to brick-and-mortar stores.

NOTES:

As the market develops, we regularly review and update our classification and grading system as well as the methodology to ensure the relevance and focus of our research on the actual market situation.

Since 1Q21, in this report:

• Supply indicators to cover malls classified as Community Centre, Regional Shopping Centre and Super Regional Centre.

• Performance indicators to cover Prime retail properties only (a subset of Supply basket above). This is one of the most highly sought-after property types on the market.

Subsequently, this revision might result in some changes in historical data.

Please refer to Terminology for a detailed definition of all the above new terms.

[1] Prime rents refer to average net effective rent of Prime Mall across the city, excluding VAT and service charges. Please refer to terminology for definition of Prime Malls

[2] City Centre refers to Hoan Kiem, a part of Ba Dinh and Hai Ba Trung District. City Fringe refers to the rest of the city.

Source: JLL Research