HCMC Apartment for Sale Market 4Q21

Strong demand after social distancing

New supply recovery in “new normality”

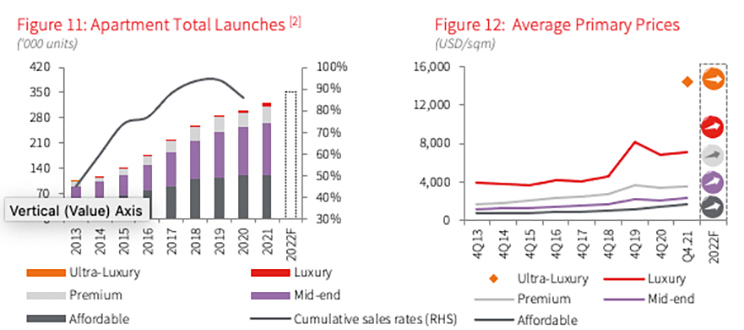

New supply has bounced back with 6,487 units, up 4 times compared to the previous quarter, contributing to the total supply of this year at over 18,000 units. Despite existing post-covid-19 restrictions, 59.6% of total supply mostly came from mid & high-end projects, such as Masterise Centre Point, Happy One Premium and West Gate Park, particularly high-end grade, contributed 48.2% to the total supply. Easing approvals and increasing resolving legal issues of HCMC authority also made contributions to this recovery.

Strong demand after social distancing

In 4Q21, total transaction volume reached 5,815 units, up 66.7% y-o-y after the well-controlled pandemic and easy participation in direct launching events. Additionally, compressed demand in the social distancing time frame was a reason for an increase of 92.7% towards the sales rate in 4Q21. A balance between supply and demand, especially not much disparities between total units taken in high-end and mid-end grade, with the average quantity was around 2,000 units per grade.

Positive price escalation in the primary market

The average primary selling price achieved USD 2,732 per sqm[1], up 1.8% q-o-q and 10.5% y-o-y. In High-end segment, average primary selling price reached USD 4,512 per sqm,up 1% y-o-y but down 11.4% q-o-q, mainly caused by lower-than-average prices in Masterise Central Point project due to its remote location. The project price, however, is considerably high compared to other projects in the surrounding area. Mid-end projects such as West Gate Park and Happy One Premier had better asking prices, with the primary selling price at USD 1,326 per sqm and USD 2,054 per sqm, respectively.

In tandem with keeping pricing strategies going up, developers also offered attractive payment assistance policies such as paying only 15% of total apartment value with interest-free loans until handover time or giving a discount of up to 7% and interior accompanying gifts.

Outlook: Market recovery and vibrancy after strict isolation

After the depression in construction works due to distancing regulations, many projects are under relaunch and predicted to provide up to 32,400 units to the new supply in 2022. Transaction activities are expected to grow strongly, thanks to the existing stable demand as well as digital sales channels, making a good approach to the potential buyers.

The supply chain of building materials was interrupted due to the pandemic impact and will continue making an impulse for raising the selling price in the future. Limited land banks in the inner city will facilitate the development of commercial housing projects in suburban districts and neighbouring provinces.

Note:

[1] Prices exclude VAT and sinking fund/maintenance fee.

[2] Official launch: Projects are considered as officially launched when the Sale Purchase Agreements are signed, typically upon foundation completion.

[3] The loan approved by owner’s collateral and other conditions.

Source: JLL Research