HCMC Office Market 4Q21

Two Grade B buildings in Non-CBD entered the market in 4Q21

Two Grade B buildings in Non-CBD entered the market in 4Q21

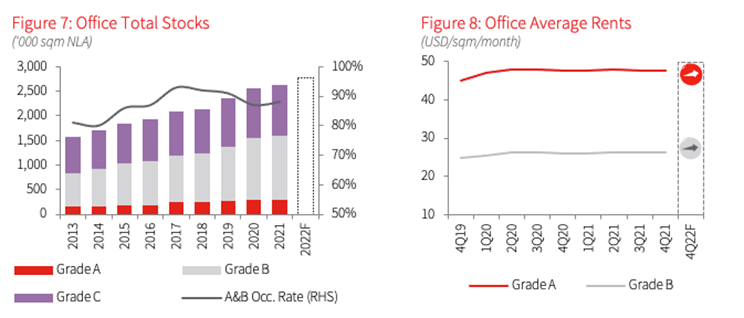

In 4Q21, the market welcomed two new Grade B buildings namely Pearl 5 in District 3 and The Grace in District 7, adding 19,000 sqm NLA to the total supply. Meanwhile, the market recorded no new supply in Grade A segment.

New supply drive the demand

Net absorption of Grade A & B offices was improved, at 20,030 m2 transactions in the quarter, mainly from the new Grade B buildings with large vacant space, thanks to landlords offering attractive rental concession policies. However, most of existing buildings in both segments recorded negative absorption due to tenants terminating early, reducing occupied areas or relocating to lower rent buildings under the impact of the pandemic.

The Grade A vacancy rate remained tight at 7.0% in 4Q21, thanks to the large lease deals that occurred in the quarter. Meanwhile, Grade B vacancy uplifts due to new completions during the year.

District 3 witnessed largest rental change q-o-q

In 4Q21, the average rent of Grade A & B offices remained at USD 30.6/m2/month[1], stable q-o-q and y-o-y. District 3 witnessed the largest change q-o-q, up 6.3% thanks to a new high-quality supply namely Pearl 5. Rents have remained resilient in most buildings across districts, with new transactions mainly happening in some new buildings.

Despite the increase in available space, landlords were generally keen on keeping rents stable. Meanwhile, new buildings tended to attract tenants with more incentive programmes.

Outlook: The Grade A basket will be adjusted based on the renovation plan in 2022

No new Grade A supply and very limited Grade B buildings are expected to be completed in 2022.

In the context of softening demand, buildings with large vacant spaces have been still under pressure to fill vacancies and thus likely to reconsider their leasing terms to be more attractive.

The rental growth in 2022 is heavily driven by higher rents expected in new completions while rental level in existing buildings tend to be stable.

Note:

[1] Rents refer to average net rent of the Grade A and B office markets, excluding VAT and service charges.

Source: JLL Research