HCMC Retail Market 4Q21

Slow resuming of footfall after reopening in early October

Slow resuming of footfall after reopening in early October

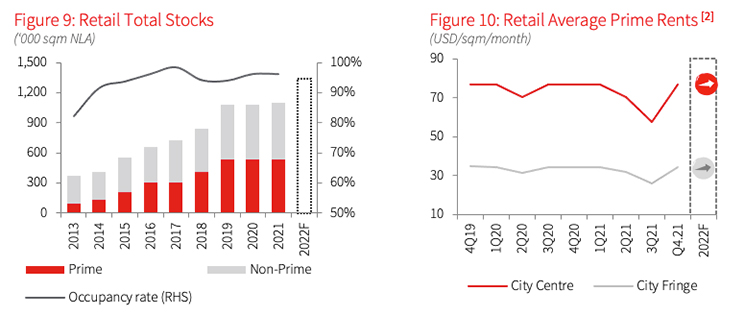

HCMC has lifted social distancing since early October, allowing shopping malls to reoperate, yet the footfall is resuming slow. The market welcomed the first mall in Binh Chanh District, namely Saigon Mia. After several deferred openings due to the pandemic, this neighbourhood mall finally officially operated in 4Q21. No new prime supply was recorded in this quarter, with all the projects deferring their launching plans to 2022, including the under-renovating Union Square shopping mall, due to the difficulty in finding tenants.

Vacant space increased significantly post-outbreak in light of the weakened demand. A total of around 20,000 sqm vacant space increased in the market after 4 months of lockdown.

Weak demand led to negative net absorption across all malls

The weak demand due to the prolonged pandemic led to several local brands withdrawing in 4Q21, resulting in negative net absorption across all malls in the survey basket. Compared to 4Q20, while occupied space at the B1 level remained stable, the demand toward upper floors weakened y-o-y, mainly at the ground level. Levels 4 & 5, with most of the high-end brands and food & beverage tenants, were under the huge impact of the pandemic.

Rental concessions were lifted after reopening

The net effective rent recovered to the normal level when all malls reopened in early October. Despite that landlords lifted the rental concessions policy, they were still willing to negotiate with tenants to provide support on a case-to-case basis.

Outlook: The market will improve in 2022

Union Square in City Centre is expected to resume the operating of B1 floors in 2022New retail centres planning grand openings in 2022 include Socar Mall and other neighbourhood shopping centres in the podium of mixed-use projects.

In light of the new supply and recovery demand post-Covid, rental is expected to increase at USD 90,4 per sqm per month and USD 37 per sqm per month in City Centre and City Fringe, respectively.

NOTES:

As the market develops, we regularly review and update our classification and grading system as well as the methodology to ensure the relevance and focus of our research on the actual market situation.

Since 1Q21, in this report:

- Supply indicators to cover malls classified as Community Centre, Regional Shopping Centres and Super Regional Centre.

- Performance indicators to cover prime retail properties only (a subset of supply basket above). This is one of the most highly sought-after property types on the market.

Subsequently, this revision might result in some changes in the historical data.

Please refer to the Terminology for detailed definitions of all the new terms mentioned above.

Note:

[1] Prime rents refer to average net effective rent of Prime Mall across the city, excluding VAT and service charges. Please refer to terminology for definition of Prime Malls

[2] City Centre refers to District 1. City Fringe refers to the rest of the city.

Source: JLL Research