Northern Industrial Land and Ready-built Factory (RBF) 2Q2022

Industrial land supply increased

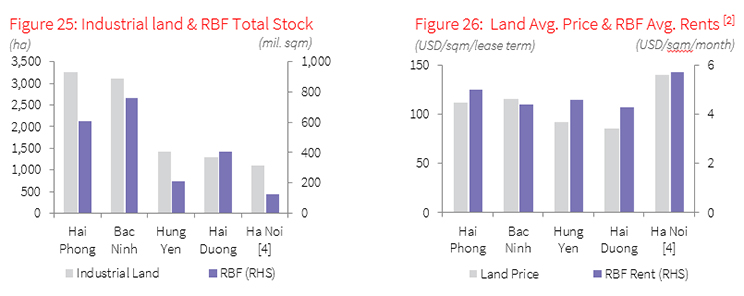

In 2Q22, the industrial land market recorded an additional 130 ha of land for lease when An Phat 1 IP in Hai Duong was officially started building infrastructure to welcome investors, bringing the total industrial land supply in the North to 10,154 ha. RBF market in 2Q22 continued to be quiet with no new supply recorded in the quarter. The total RBF supply in the North remained at 2.2 million sqm.

The occupancy rate remained high

The occupancy rate of IPs in the North in 2Q22 was recorded at 79%, a slight decrease of 1% q-o-q due to the low occupancy rate of newly established IPs. The occupancy rate of RBF continued to be high, standing at 99% by end of this quarter.

According to the General Statistics Office, in the first half of 2022, the industrial production index of some key industries increased sharply y-o-y. FDI inflows continued to pour into the Northern provinces. Notably, the Hai Phong Economic Zone Management Board awarded Investment Certificates to six investment projects in the economic zone with a total investment of up to USD 400 million. Of these, the development logistics and warehousing services project in Nam Dinh Vu IP of ESR V Investor 4 Pte. Ltd, with a scale of 120,000 sqm and a total investment of USD 33 million is one of the most notable projects.

Land rental prices increased slightly

Land rent in 2Q22 reached USD 110 per sqm per lease cycle, up by 4.4% y-o-y. Bac Ninh sustained its second highest rent in the market after Hanoi, thanks to its convenient location and increasingly limited industrial land in the province. RBF rent remained unchanged this quarter, at USD 4.7 per sqm per month.

Outlook: New supply enters the market in the second half of 2022

In 2H22, the industrial land market is expected to welcome the new Tien Thanh IP in Hai Phong, as the project was recently awarded investment registration certificate and construction is expected to start by the end of this year with a total investment of over VND 4,500 billion. Meanwhile, Gia Binh II IP in Bac Ninh is also ready to begin construction to attract investors.

In the RBF market, the project of KCN in Deep C Industrial Park (construction started in May 2022), KTG's project in Yen Phong II-C Industrial Park and one project of Tuong Vien Group in the Nam Dinh Vu IP are under construction and will be ready for handover in 3Q22. These projects promise to be a significant addition to the limited supply of the RBF market when the leasing demand for this product type from manufacturers is continuously increasing.

Note:

[1] Greater HCMC area consists of HCMC, Binh Duong, Dong Nai, Ba Ria – Vung Tau and Long An markets.

[2] Prices exclude VAT and sinking fund/maintenance fee. Price per sqm land = total unit value / size of the land plot on which the property is built.

[3] Official launch: Projects are considered as officially launched when the Sale Purchase Agreements are signed, typically upon infrastructure completion.

Source: JLL Research