Southern[1] – Industrial Land and Ready-built Factory (RBF) 4Q21

Occupancy rate went up in both property markets

Industrial land got back to normal bit by bit

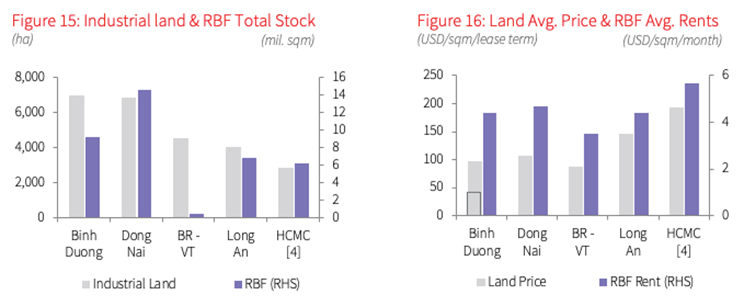

Due to serious impacts of the fourth Covid-19 wave with no new supply in 3Q21, the total leasable land area remained at 25,220 ha. In 2022, Nam Tan Lap IP in Long An province and VSIP 3 in Binh Duong are expected to enter the market, helping these market keep vibrant. Though the RBF market recorded only a new supply in Nhon Trach district-Dong Nai province, several new RBF projects have made the initiation of construction and are anticipated to be launched in 2022. In tandem with the RBF market, the total supply of this type reached 3.7 million sqm at the end of 2021.

Occupancy rate went up in both property markets

The Southern market has bounced back gradually after the huge impacts of Covid-19 in 3Q21. All IPs have already gone back to work, many large-scale FDI continued flowing into the South, particularly the LEGO plant with a total investment value of 1 billion USD in 2022-2024. Long An also welcomed a new investment project of a Japanese investor with the capital contribution value of USD 35 million, flowing into Pharmaceutical Joint Stock Company of February 3rd in Long Hau 3 IP (phase 1). The occupancy rate of IPs and RBFs made an increase of 90% and 86%, respectively.

Land prices gained growth momentum, whilst RBF rents got a new peak

With the reopening of the economy in 4Q21, the recovery of industrial activities helped land prices gain growth momentum with the specific price at USD 117 per sqm per lease term[2], up 7.3% q-o-q. RBF rents achieved USD 4.7 sqm per month, an increase of 4.9% q-o-q, mostly in Long An province. Binh Duong and Dong Nai Ips were nearly filled up. Improved infrastructure connectivity between HCMC and Long An got much more attention to Long An province and brought land prices/RBF rents growth opportunities.

Outlook: Green IP and RBF trends taken into account by investors

Regardless of the bad results of Covid-19 in 2021, Long An, HCMC, Binh Duong provinces were in the top 5 FDI attractions throughout the nation, highlighting the strong potential of Southern provinces in the investor’s eyes. Besides traditional industrial sectors, some sectors, such as pharmaceutical, medical equipment, data centre, are predicted to be new growth motivations. Trends of sustainable development have been considered initially by investors, with adaptabilities to green planning and building standards in new IPs/RBFs. The increasing demand of finding land banks to build logistics facilities to meet the needs of e-commerce and Industrial markets from foreign investors is leading the vibrancy of warehouse and logistics hub markets.

Note:

[1] Southern area consists of HCMC, Binh Duong, Dong Nai, Ba Ria – Vung Tau and Long An markets.

[2] Land prices exclude Infrastructure maintenance fees, service fees and VAT. Lease term means the remaining land lease term of the project life time.

[3] Rents exclude VAT and service charges.

[4] Saigon High-tech Park and Quang Trung Software Park are not included in the surveyed basket owing to their special characteristics.

Source: JLL Research